Date: August 14, 2022

The rise in popularity of standing desks over the past decade has come as a result of studies showing the health risks associated with sitting too much, including back, shoulder, and neck pain as well as other risks like a higher risk of heart disease and diabetes.

Employers understand the harmful health impacts on their employees of sitting too much. The percentage of U.S. employees that have the option to have a standing desk provided or subsidized by their employer rose from 20% in 2014 to 60% in 2019.

Given the health benefits offered by desk risers, if you use Anthem, Inc as your health insurance provider, you may wonder if the cost of a standing desk can be covered by Anthem.

In this article, I will provide all of the information you need to know if Anthem will reimburse you for the cost of a standing desk.

Table of Contents

Anthem May Reimburse for Standing Desks

We have previously written about the health risks of prolonged periods of sitting, including higher risks of diabetes, obesity, and cardiovascular issues.

Given the increased understanding of the harmful effects of sitting too much, it raises the possibility of health insurers like Anthem covering the cost of a standing desk.

Before you purchase a desk riser, we recommend contacting Anthem, Inc to make sure they reimburse for a standing desk.

Unfortunately, in the course of our research we weren't able to find a definitive answer if Anthem will cover the cost of a standing desk, which is why we say they may cover it. Below is information we gathered during our research.

What is Durable Medical Equipment (DME)?

In reviewing Anthem’s reimbursement policy, they allow for reimbursement of what they call durable medical equipment (DME).

According to Anthem, durable medical equipment is an item that meets the following criteria:

- Are primarily and customarily used to serve a medical purpose rather than convenience or comfort

- Can withstand repeated use

- Generally, are not useful to a person without an illness or injury

- Are appropriate for use in the home

- Are prescribed by a licensed physician/practitioner

Anthem states that they do not reimburse for a “purchase or rental of common household items that are not medically indicated”. So again, we highly recommend contacting Anthem before purchasing a standing desk to see if they reimburse for them.

What Durable Medical Equipment (DME) Does Anthem Not Reimburse for?

More on what Anthem does NOT reimburse for below:

Anthem requires that all durable medical equipment claims be submitted with the applicable HCPCS code(s) and have the applicable modifier appended.

What Is A HCPCS code?

The Healthcare Common Procedure Coding System (HCPCS) is a collection of standardized codes that represent medical procedures, supplies, products, and services. The codes are used to facilitate the processing of health insurance claims by Medicare and other insurers.

HCPCS codes are standardized to allow for orderly and consistent processing of claims for health insurance coverage. The coding system is broken down into two subsystems: Level I and Level II.

Level I of the HCPCS is comprised of Current Procedural Terminology (CPT), a numeric coding system maintained by the American Medical Association (AMA). The CPT is a uniform coding system used primarily to identify medical services and procedures provided by physicians and other health care professionals. For this article, Level I is not relevant to the reimbursement of standing desks.

HCPCS Level II is a standard code system used primarily to identify drugs, biologics, and supplies and services not included in Level I. These include durable medical equipment used outside of a physician’s office, which is what standing desks may fall under, depending on the insurer in question.

What is a Letter of Medical Necessity (LMN)?

One additional step that you may want to take is obtaining a letter of medical necessity (LMN) from your primary care physician.

As we discussed in our previous article, “Can a Standing Desk be Covered by Insurance?”, a letter of medical necessity is a doctor’s note that supports the case for you having a standing desk at work. Your chances of having insurance approve the need for a standing desk increase greatly if you obtain an LMN from your doctor.

Some other things to think about regarding getting insurance to cover a standing desk:

- You may need to get an Explanation of Benefits (EOB) from your insurance company. This will show that your purchase was not covered under your insurance.

- You also will need to fill out a claim form. When you signed up for your FSA/HSA you may have received a welcome packet. If not, you could contact your plan administrator or the FSA/HSA provider website to obtain claim forms.

- You will likely have to purchase your ergonomic desk out of pocket and then seek reimbursement.

- If your purchase is covered, you will receive a reimbursement check via the mail or direct deposit into your bank account, depending on how your account was set up. Reimbursement usually will occur within 10-14 days after submission.

Here's more information to better understand FSA/HSA as an option for covering the cost of a standing desk:

Health Savings Account (HSA)

A Health Savings Account lets you pay for specific medical expenses with money you set aside on a pre-tax basis. This type of account directly lowers your health care cost since you're using untaxed dollars to cover coinsurance, deductibles, copayments, and some other expenses.

*Note: Funds from a Health Savings Account cannot be used to pay health insurance premiums.

Flexible Spending Account (FSA)

Alternatively, a Flexible Spending Account or "flexible spending arrangement" is a special account in which you deposit money to cover specific healthcare costs. You don’t pay taxes on the money you contributed to an FSA, which means you’ll save an amount equal to the taxes you would have paid on the money you set aside.

*Note: Employers aren't required to contribute to a Flexible Spending Account; it is optional and you should contact your employer first to understand the rules of an FSA.

Ultimately, these options are effective alternatives to getting your standing desk in case Anthem, Inc rejects your request. Consider exploring them as potential options.

What If Anthem Does Not Cover a Standing Desk?

If you contact Anthem directly and confirm that Anthem does not cover the cost of a standing desk, there are two other options you should explore:

- Switch health insurance providers

- Ask your employer if they reimburse for standing desks

Should I Switch Health Insurance Providers?

Considering that you can still find affordable standing desks under $200 and the monthly cost of health insurance is likely much higher than that, you probably shouldn’t change health insurance providers just because they don't cover the cost of a standing desk.

However, if you’re currently looking for health insurance providers to use or are going to switch health insurance plans, some may reimburse for standing desks. You also may have better luck with your current or prospective employer.

Will My Employer Pay For A Standing Desk?

If you don’t want to change health insurance providers or are not looking for a new health insurance provider, your best bet may be to ask your employer to pay for your standing desk.

If your company has a wellness program, there is a strong likelihood they will cover at least a portion of the cost of your standing desk.

The trend toward using sit-stand desks at companies is growing. Out of the companies that have increased benefits offerings, 44% of them increased wellness benefits in 2018 alone. Standing desks fall under the wellness umbrella.

Apple made the headlines a few years ago when CEO Tim Cook said that all Apple employees will get standing desks and that he believes "sitting is the new cancer."

The use of standing desks in wellness programs grew tremendously from 20% to 53% from 2014 to 2018 (when Tim Cook made his comments), as shown in the chart below from the Society of Human Resource Management.

Why You Need a Standing Desk

As we discussed in our article, “Is Sitting Too Much Bad for You?”, sitting for prolonged periods can produce serious health complications like heart disease, diabetes, weight gain, and early death.

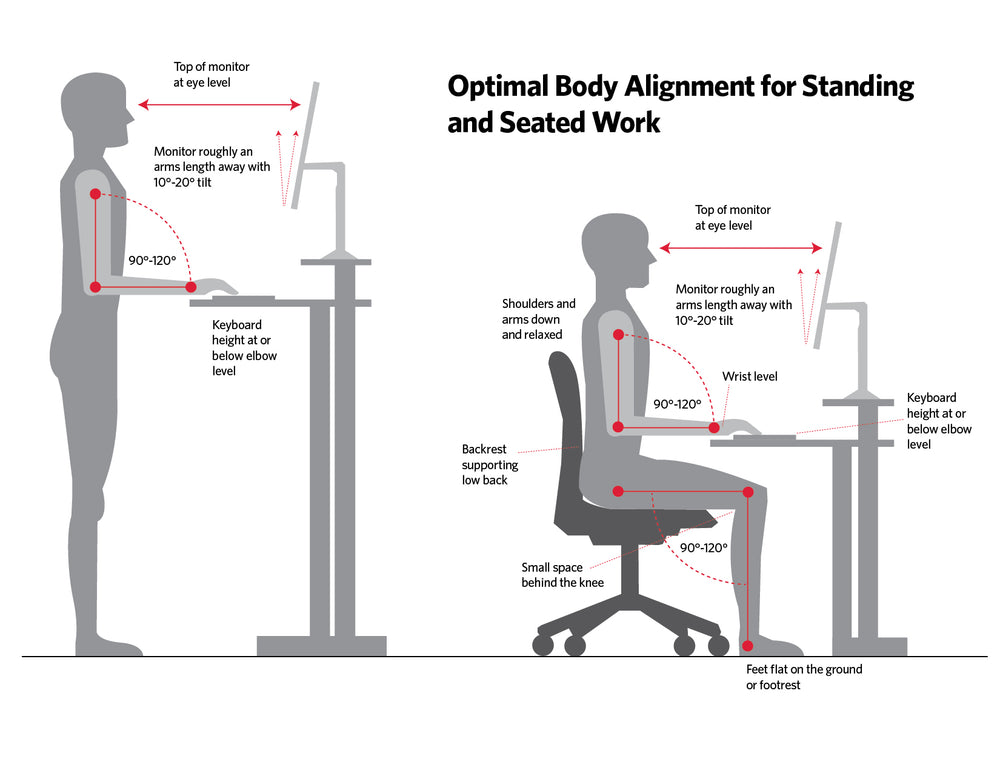

A standing desk also improves blood circulation and drastically reduces your chances of blood clots. While it is recommended to take breaks from standing throughout the day, using desk risers for just a portion of your workday is an effective way to curb the negative impact of sitting too long.

We have written previously about all of the positives that come from switching to a standing desk while working. Other benefits of a standing desk include:

MORE CALORIES BURNT

According to this study, one hour of standing helps you burn 210 calories as compared to sitting, which only consumes 88 calories.REDUCED BACK PAIN

Your lower back suffers from sitting for extended amounts of time as your muscles tighten, especially if you have a poor posture or a related medical condition. In this case, a standing desk can help ease the pain without sacrificing comfort.PRODUCTIVITY

Further studies on the efficacy of standing desks showed that employees were more productive by 45% while completing tasks standing.Ultimately, using a standing desk at work is an effective way to build better posture, reduce back pain, and increase your productivity.

Conclusion

In reviewing the policies of Anthem, it is not entirely clear if they cover the cost of a standing desk. While the benefits of standing desks are becoming more understood and they’re used in the majority of workplaces, it seems to be taking longer for health insurers to reimburse for the cost of a standing desk.

As we mentioned before, you should contact Anthem to confirm whether or not they reimburse you for a sit-stand desk. If they do not, you can try these 3 options:

- Switch health insurance providers – likely not your best option as discussed above.

- Research if you can purchase it through an HSA or an FSA program.

- Ask your employer to reimburse you.

After you have done your research and are ready to purchase a desk riser, check out a great new tool we developed called the Desk Finder, which can help you find the perfect standing desk based on your height and the number of monitors you use.

FAQs for Anthem Reimbursement of Standing Desks

| Q: Does Anthem reimburse you for a standing desk? |

|

A: As of this writing, we haven't found definitive evidence that they reimburse you for the purchase of a standing desk. We recommend contacting Anthem directly and asking them if they cover the cost of a standing desk. While many insurers advocate the use of a standing desk, many are still on the sidelines about covering the cost of a standing desk for their members, including Anthem. One option that could work if Anthem doesn't reimburse for a standing desk is to use the money you contribute to a Flexible Spending Account (FSA) or Health Savings Account (HSA) to purchase your standing desk. You don’t pay taxes on the money contributed to these accounts, which means you’ll save an amount equal to the taxes you would have paid on the money you set aside. |

| Q: Is a standing desk considered durable medical equipment (DRE)? |

|

A: While there is some gray area regarding the definition of DRE (described in detail above), you can make the argument for a standing desk being durable medical equipment in that it (a) can "withstand repeated use", (b) useful to a person with an illness or injury (e.g., spine injury, back pain or neck pain), and (c) is "appropriate for use in the home". The best thing to do is to consult with your primary care physician and see if you can get a letter of medical necessity (mentioned above), which is essentially a doctor's note saying you have a medical condition and would benefit from a standing desk. |

| Q: Do you have a sample letter of medical necessity (LMN)? |

|

A: Each insurance provider should have their own LMN form on their website so be sure to do a Google search for your insurer's LMN. Here is a sample LMN from HealthEquity:

|